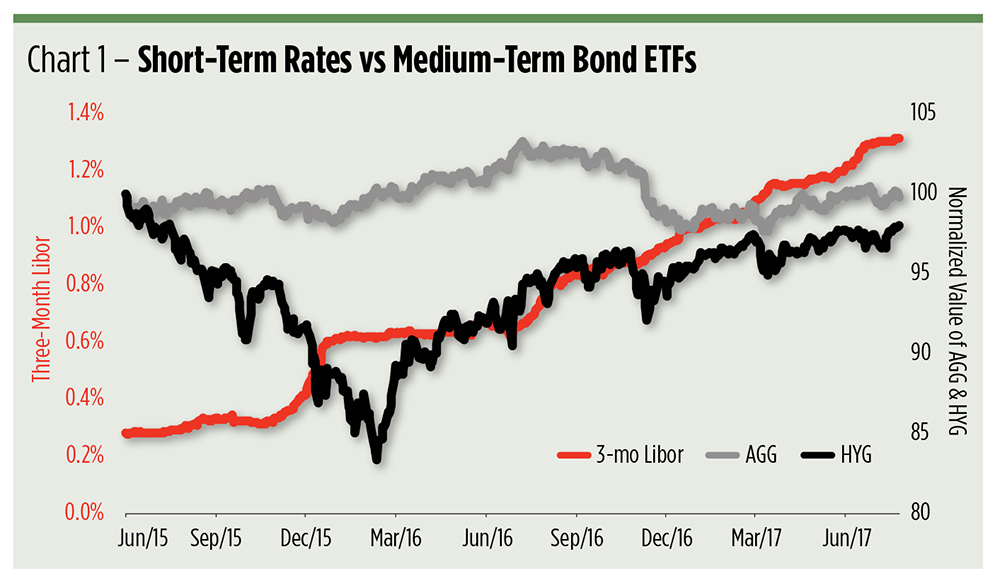

Beep is financial industry jargon for basis point which is 1 100 of a percentage point in the context of interest rates bond yields and other debt instruments.

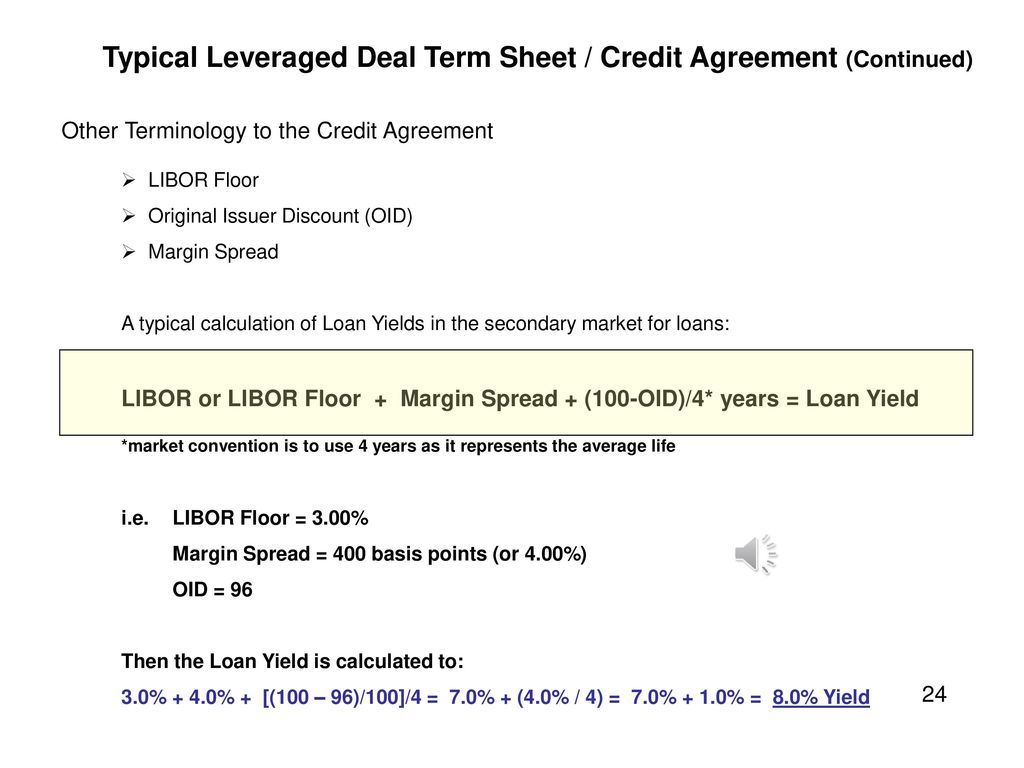

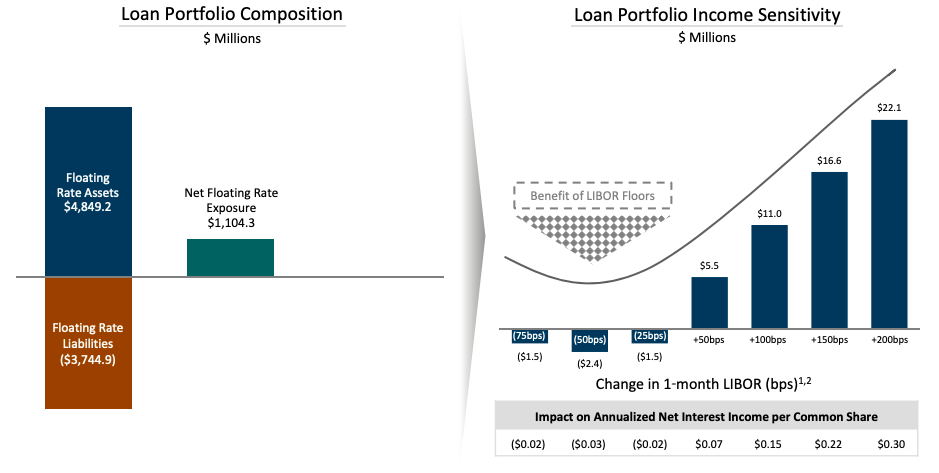

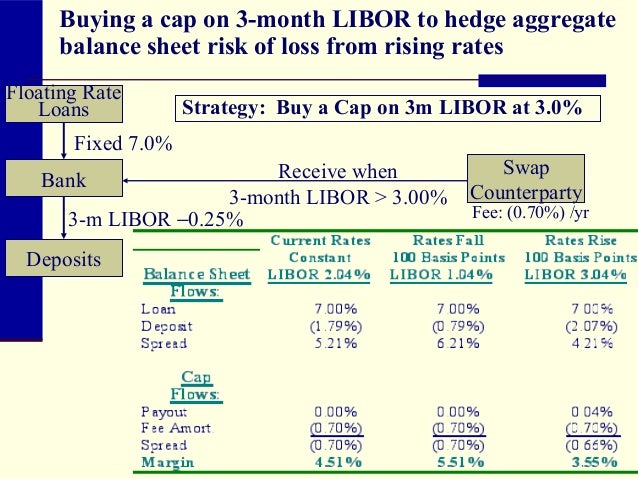

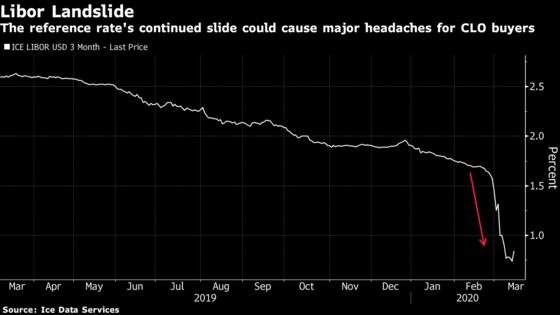

Libor floor of 100 basis points.

The term came into.

It is very simple to calculate basis points using a very straightforward formula.

Basis points are most commonly used when differences of less than 1 are meaningful.

Basis points bps represent a unit that is employed to measure interest rates and other financial percentages.

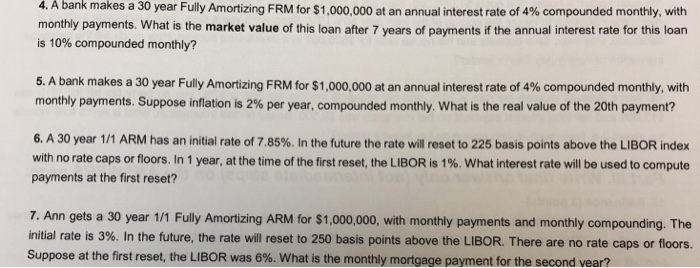

That is 100 basis points 1 percent theoretically of any measured quantity.

Bps are used for measuring interest rates the yield of a fixed income security fixed income bond terms definitions for the most common bond and fixed income terms.

As such it can be denoted as 0 01 or 0 0001 in decimal form.

When the fed benchmark interest rates are changed they usually go up or down by 25 basis points.

What are basis points bps.

A basis point is one hundredth of a percentage point.

Etc and other.

What are basis points.

For example the difference between 1 25 and 1 30 is five basis points.

In finance basis points bps are a unit of measurement equal to 1 100th of 1 percent.

Annuity perpetuity coupon rate covariance current yield par value yield to maturity.

A basis point is equal to 1 100 th of a single percentage point.

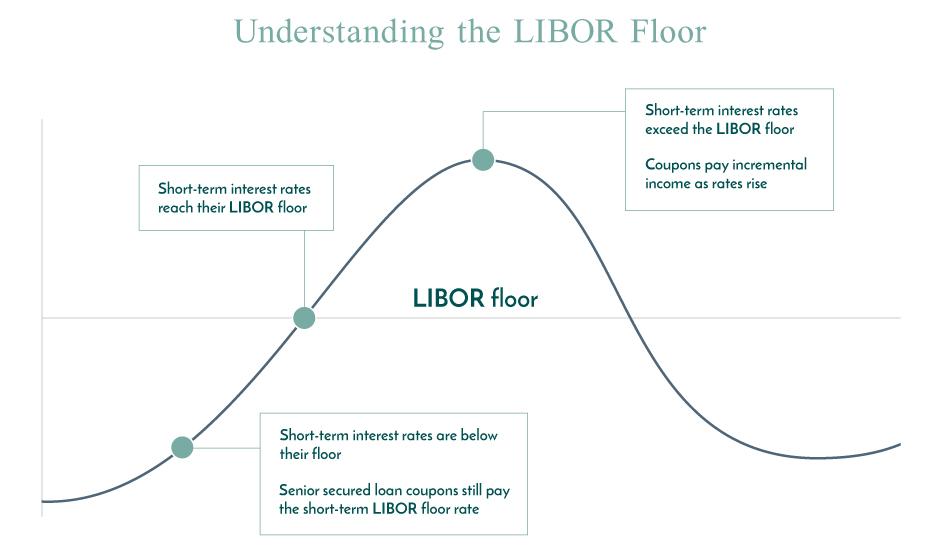

A floor is essentially like a put option but on the libor rate.

If the libor falls below the predefined rate of your floor you can exercise the floorlet and receive the spread between 3m libor and the exercise rate.

/HowToReadInterestRateSwapQuotes1_4-ee013a308ef948ecb3ed106d6259a3f0.png)