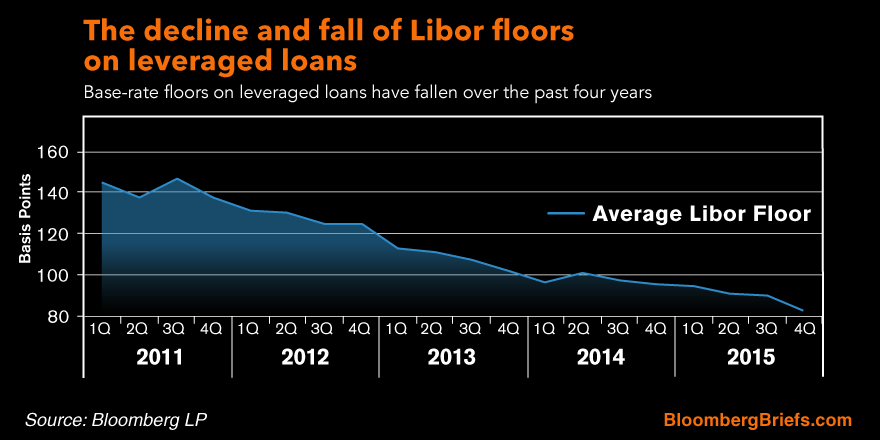

Duff phelps and kissner group were among companies that added a so called libor floor the minimum rate a key lending benchmark can be set at to its financing packages this week to ensure.

Libor floor rate.

The libor rates which stand for london interbank offered rate are benchmark interest rates for many adjustable rate mortgages business loans and financial instruments traded on global.

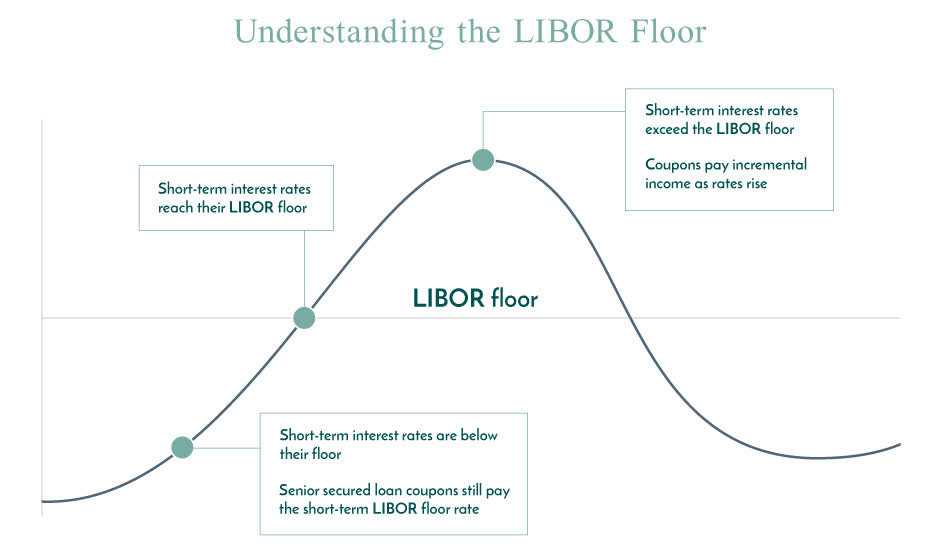

If libor is below this rate then the libor floor will be the new libor rate minimum contractual return.

The london interbank offered rate libor is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short term loans.

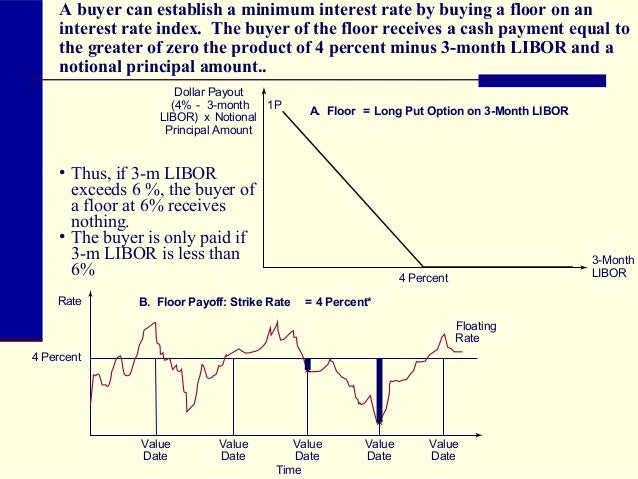

The higher the floor the more valuable the option is for lenders and the more costly it is for borrowers.

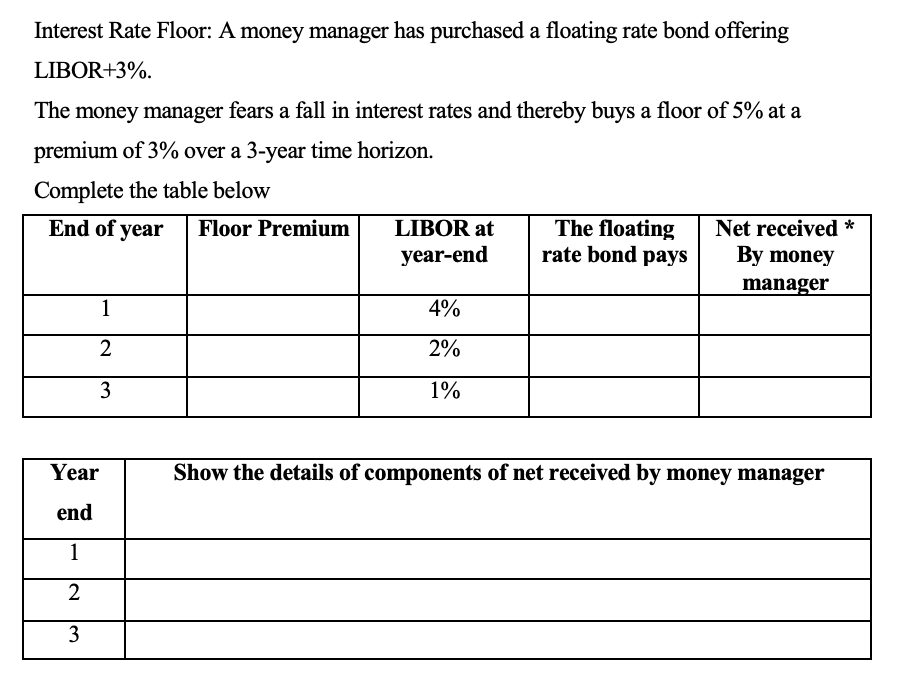

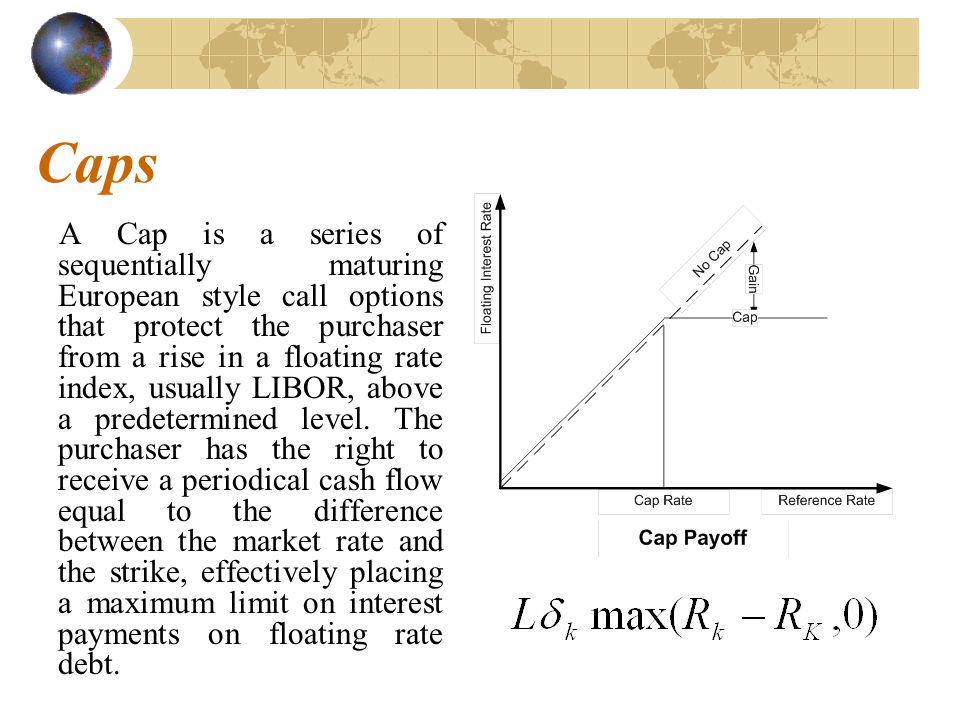

An interest rate floor is a series of european put options or floorlets on a specified reference rate usually libor.

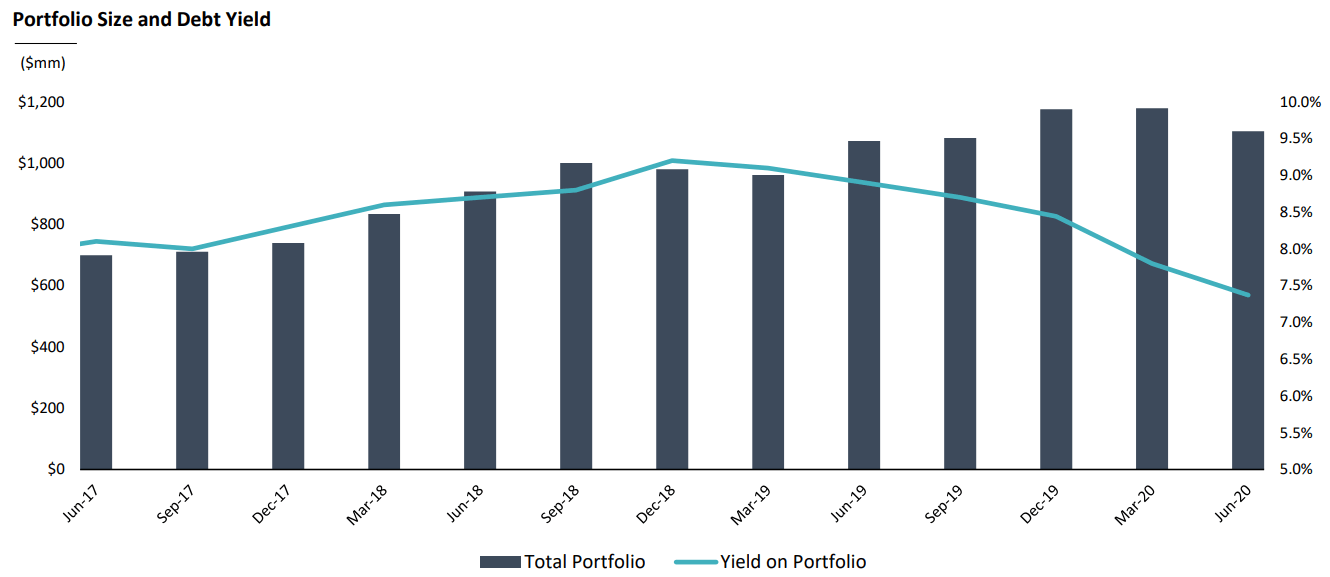

Minimum return expected which is determined by the spread above libor and the contractual libor floor applicable to each loan other fees.

Original issue discount and call protection fees.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

The buyer of the floor receives money if on the maturity of any of the floorlets the reference rate is below the agreed strike price of the floor.

For instance a 1 floor allows the lender to replace any future libor settings below the floor with the floor itself.

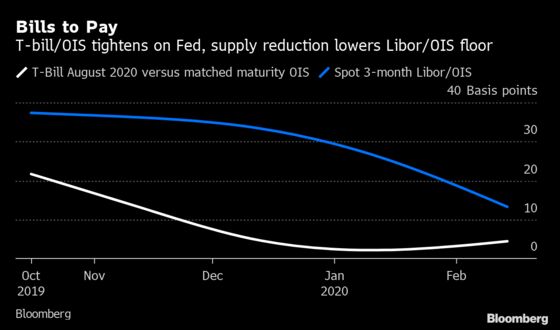

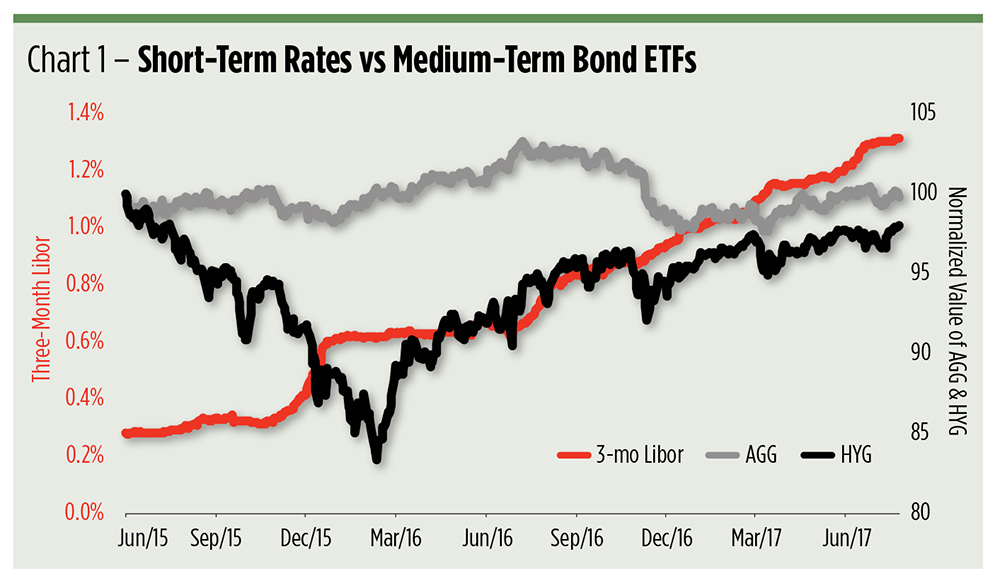

Libor has swooned and hasn t fully recovered in recent weeks.

Interest rate floors are utilized in derivative.

Today most loans offer a 1 libor floor and the 3 month libor rate stands at 0 25 meaning a loan with a libor floor gives investors a yield base that s three quarters of a percentage point.

On march 2 one month libor was at.

If libor is below this rate then the libor floor will be the new libor rate minimum contractual return.

The strike is the stated rate under which the borrower does not benefit from declines in libor.

Minimum return expected which is determined by the spread above libor and the contractual libor floor applicable to each loan other fees.

Interest rate collars and reverse collars.

The new term loan b bears interest at libor floor of 0 75 plus an interest rate margin of 2 75.

)